By: Giselle General

Most people plan elaborate parties, find a fun public event with fireworks and a festive way to count down to midnight, some even post a long heartfelt social media posts with photos taken throughout the year, others may claim that staying at home to have a restful night is the best way to spend the day. There’s a wide array of things people do to bring in the new year.

For my husband and I, we eagerly count down to our distinct personal occasion, that we tell people about it. Do we look forward to this day with the same enthusiasm as our anniversary? It’s possible!

It’s our annual Budget Deliberation Day! It’s when we wait until the last business day of the year for our online purchases to process, add all the information in our budgeting software, assess our expenses for the past 12 months and then set our budget for the upcoming year.

When a colleague asked my husband what activities we have planned for the holiday break, he mentioned about Budget Deliberation Day. His colleague claimed “if my spouse and I do that, we will get divorced!” I can see how that can be the case for many couples and families. It’s difficult to talk about money. Having what could look like a business meeting to talk about an integral part of our personal lives, can feel coldhearted and harsh. I suppose for my husband and I, that is the point of having a dedicated day and process for this, it eliminates stress and anxiousness because it is predictable, safe, calm and with a mindset of informing and supporting each other.

We did not do this right away after we moved in together. What I do know was when he bought his own home for the first time, he also got a budgeting software. Just as boyfriend-girlfriend at that time, whenever I come over to his place, he would eagerly show the charts and graphs of his income and expenses and the sub-categories for each. During this time I was living with my relatives still, who didn’t have a system about budgeting that they taught me. So I was winging it as a young adult in my 20’s, using spreadsheets and even the free version of the Mint budgeting app at the time.

When we moved in together I still used my own system, including the built-in budgeting interface that was part of my bank’s online banking. Year after year, the boyfriend – then turned common-law partner – continued to show me the software, gently encouraging me to finally give it a try. When my bank removed the budgeting section off their online banking, I figured it is time to do it. If we are going to build a life together long term, might as well have an easier way to discuss finances. After all, we are “team communicate!”

So what happens during budget deliberation day? Not a whole lot actually. Since throughout the year, we regularly add our budget information in the software, we already have a good sense of our income and expenses. It’s not like we have no clue what is happening and have sort through 12 months of information. We check the long term information such as net worth, investments, money we can easily access and withdraw. We check our income and expenses to see how much they match up with what we have anticipated at the beginning of the year.

One very important thing to note is this is not a time to shame each other, and ourselves, if we went over budget on certain categories. Since we are not in debt and have some money in our chequing account, we know that going over budget is not going to hurt us in the long run. It could be just a sign that for next year, we just need to increase the budget in that category.

Our categories are not identical either, and that is not the point for us anyways. For me, I wanted to clearly see how much I spend on groceries compared to eating out, so those are separate categories. For the husband, eating out is combined with the rest of his “fun personal” expenses category. For the longest time it was difficult for me to set boundaries about giving financial help to relatives overseas. Setting the budget for that category and assessing it every year helped me set boundaries so I can help wholeheartedly without being resentful, and without compromising my financial goals. Besides, if I get into financial trouble, no one from the motherland can help me.

We plug our computers onto the monitor and show each other the software page, the chats and the numbers. We might have to ask to raise a budget category. The whole thing takes about two hours tops. Today we finished right before lunch, and that’s with both of us sleeping in.

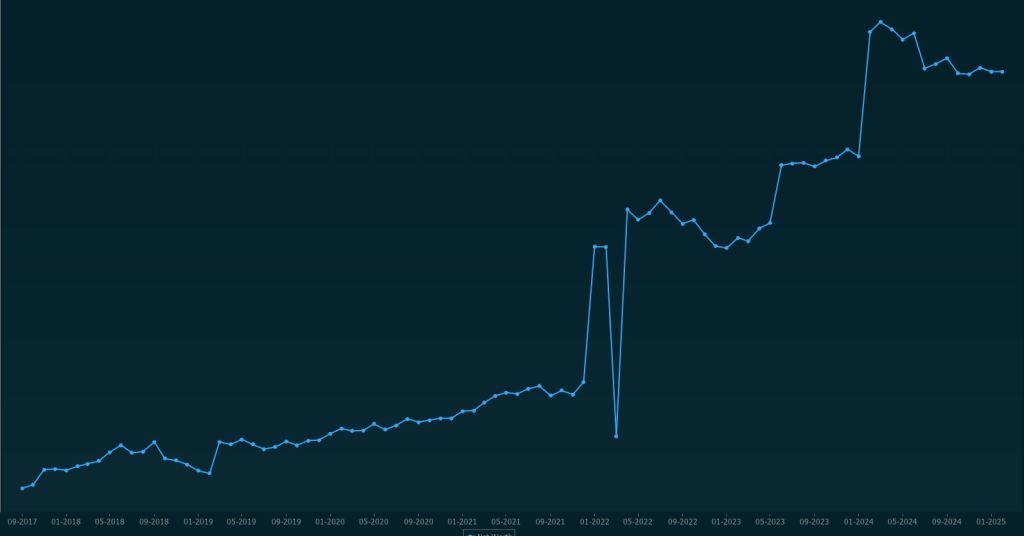

The software is not the fanciest one around but that never mattered to us. The colours are straightforward enough, and the charts in different formats (line, pie, bar, doughnut, custom) are fun to read. We have this in our computers, so not an app on our phone, which I think prevents us from obsessing about budgeting in a toxic way.

He’s used the budgeting software for 15 years now, and I have for seven. I think the most fascinating realization for me is how the numbers and charts tell a story. In his net worth chart, the largest dip in the line graph was when we traveled overseas for the first time. He had to spend a lot of money and also lost wages for three months. For me, the steepest decline in my line graph was when we downsized from a single family home to a town house and I used my savings to pay for a portion of the house. It’s so worth it though – because we were mortgage free afterwards!

Budget Deliberation Day is also an opportunity for us to talk about potential big expenses for the upcoming year. This helped us plan for a new roof, hot water tank and furnace. This helped us plan for our big adventures, whether it is travel, changing careers while ensuring we can pay our bills while finding a new job, running for politics, or aggressively increasing our retirement savings. I personally think that unexpected financial surprises, especially the type when the other person can claim “you could have talked to me about this sooner because you knew!” is what causes conflict between couples, not the actual numbers being shown in the budget.

It’s truly a solid way to start the year, secure and confident in my ability to be financially aware, appreciate my spouse for his diligence, and look forward to our future together.